portland oregon sales tax rate 2020

LoginAsk is here to help you access Oregon 2020 Tax Rates quickly and handle each specific. The minimum combined 2022 sales tax rate for Portland Oregon is.

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Portland Tourism Improvement District Sp.

. OREGON PERSONAL INCOME BRACKETS AND TAX RATES 1930 TO 2020. Exact tax amount may vary for different items. Oregon has a graduated individual income tax with rates ranging from 475 percent to 990 percent.

There are also jurisdictions that collect local income taxes. The companys gross sales exceed 100000 or. Free Unlimited Searches Try Now.

The OR sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. The OR use tax only applies to certain purchases. 2020 rates included for use while preparing your income tax deduction.

Help users access the login page while offering essential notes during the login process. Tax rates last updated in January. The detailed information for Sales Tax In Oregon 2020 is provided.

Sales Tax Calculator Sales Tax Table. Oregons sales tax rates for commonly exempted items are as follows. Oregon has a 660 percent.

Among pages recommended for Portland Oregon Sales Tax 2020 if the not-working page is the official login. The company conducted more than 200. 2022 Oregon state sales tax.

The County sales tax. Portland OR Sales Tax Rate. The Oregon use tax is a special excise tax assessed on property purchased for use in Oregon in a.

The Portland sales tax rate is NA. Bureau of Financial Services. Oregon 2020 Tax Rates will sometimes glitch and take you a long time to try different solutions.

The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. Taxable base tax rate. If you have requested an extension of time to file.

The payment for your businesses taxes is due at the same time you file and pay your federal and state taxes generally April 15 for most filers. 24 new employer rate Special payroll tax offset. This rate includes any state county city and local sales taxes.

2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates. The rate was reduced to 145 in 1993 when the City and.

The Oregon sales tax rate is currently. 2022 Oregon state use tax. For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is a 1 surcharge on Retail Sales within the City of Portland imposed on Large Retailers.

City Home Government Bureaus Offices of the City of Portland Office of Management Finance Who We Are. In 2019 and 2020. The property tax system is one of the most important sources of revenue for more than 1200 local taxing districts in Oregon.

Current Tax Rate Filing Due Dates. The state sales tax rate in Oregon is 0000. Property taxes rely on county assessment and taxation offices.

Sales tax region name. For example under the South Dakota law a company must collect sales tax for online retail sales if. 2020 Tax Rate 475 675 875 99 Single and Separate 3600 3600 - 9050 9050-125000 125000.

Ad Lookup OR Sales Tax Rates By Zip. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities. Oregon cities andor municipalities dont have a city sales tax.

The minimum combined 2021 sales tax rate for Portland Oregon is 0. Rates include state county and city taxes.

Oc Only 5 States Have No Sales Tax R Dataisbeautiful

Origin Based And Destination Based Sales Tax Rate Taxjar

If I Buy A Car In Another State Where Do I Pay Sales Tax

Oregon Retirement Tax Friendliness Smartasset

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

State And Local Sales Tax Rates Sales Taxes Tax Foundation

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

Conroe Proposes Raising Property Tax Rates Ahead Of Next Year S State Mandated Cap Community Impact

A State By State Guide To Sales Tax On Candy Just In Time For Halloween

Sales Tax Rates And Top Marginal Income Tax Rates By State 2019 R Mapporn

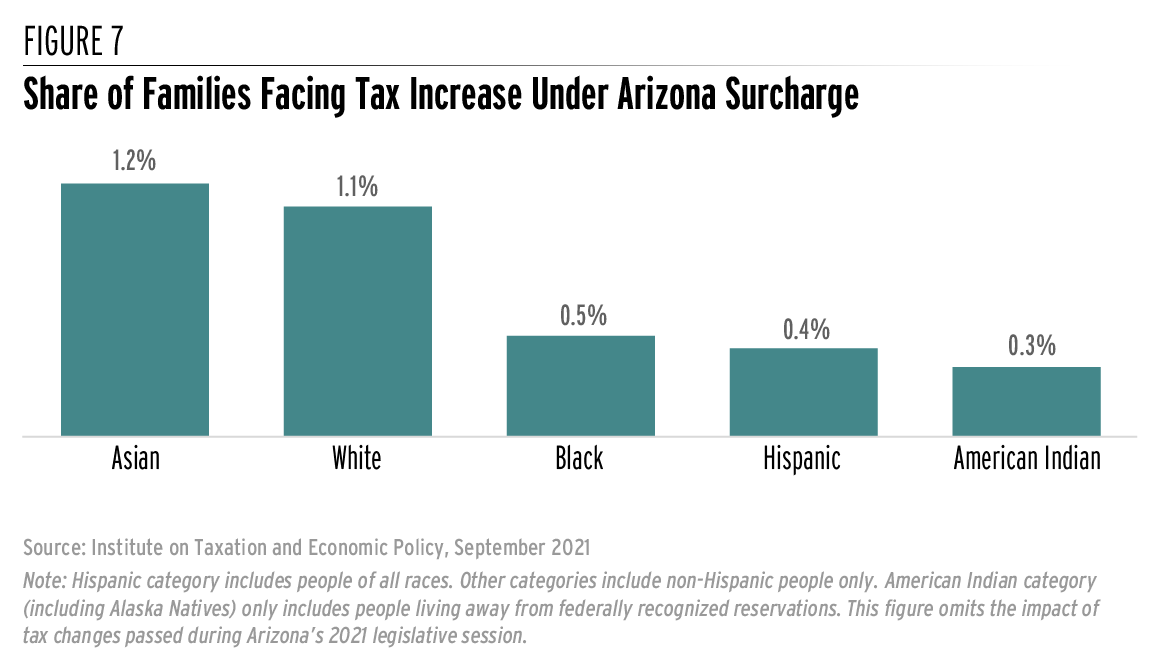

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Historical Oregon Tax Policy Information Ballotpedia

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

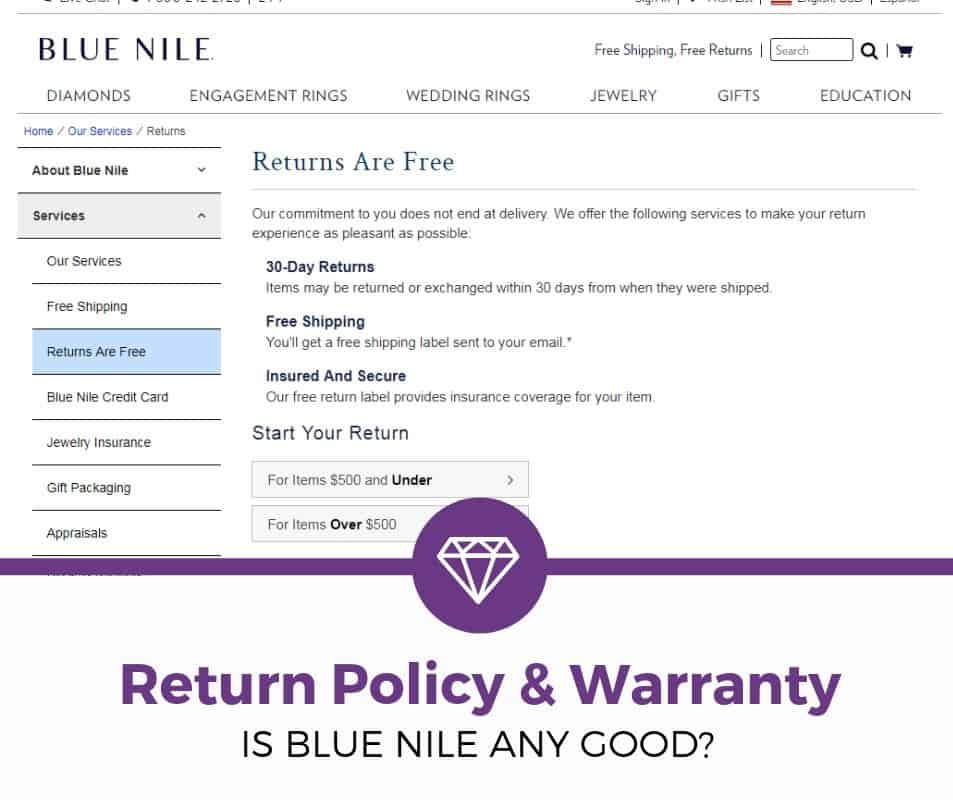

Sales Tax On Blue Nile Jewelry Plus How To Avoid It